washington state long term care tax opt out reddit

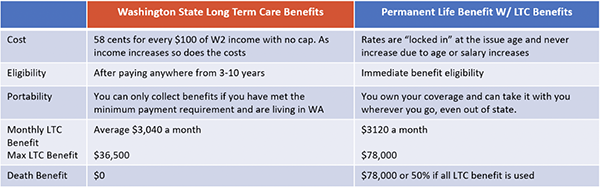

Starting January 1 2022 a 058 premium assessment will be imposed on all Washington employee wages. Washington State is accepting exemption applications between October 1 2021-December 31 2022.

Long Term Care Insurance Washington State S New Law White Coat Investor

Unfortunately the LTC insurance industry has experienced a mass-exodus hundreds of companies in the 90s to a dozen or so that still offer in WA State.

. The average long-term care insurance policy costs 2466 per year for a couple at age 55. The bag was left behind by a 23-year-old man who had stayed at a hotel in downtown Seattle and was initially discovered by a housekeeper cleaning the guests room after he had checked out. Long term care needs to be portable.

But if that same couple purchases a policy at age 60 their prices rise almost 1000 to an annual average of 3381. The hotels manager looked inside the duffel in attempt. Veterans with 70 disability can opt out.

Man arrested after accidentally leaving bag with 15000 fentanyl pills behind at Seattle hotel. It needs to stay with the person regardless of state residence. WA Cares Fund is a long-term care insurance tax of 058 of gross wages of workers in the state of Washington.

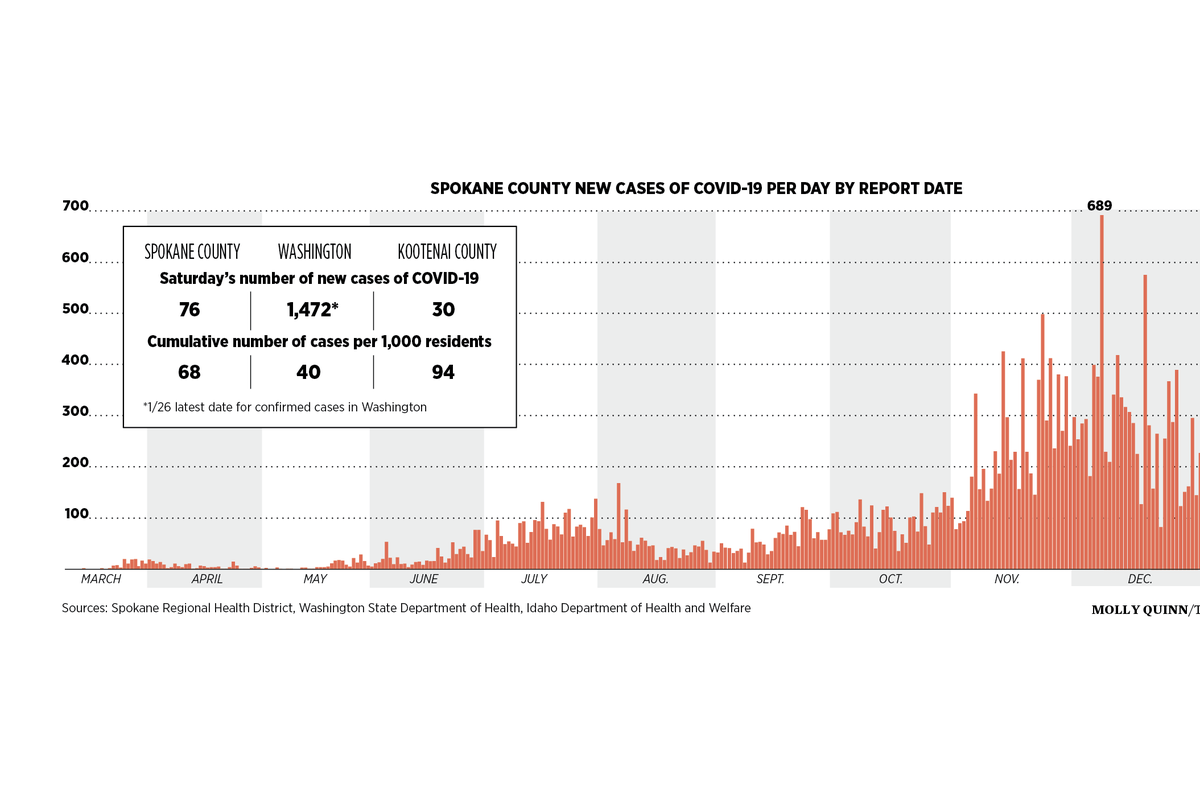

There are 5 steps you have to take in order to opt out and stay out of the Washington Cares Fund payroll deduction. A Nursing Home Chain Grows Too Fast And Collapses And Elderly And Disabled Residents Pay The Price the maximum lifetime benefit of 36500 is. Friday the states website to apply for an exemption to.

Things were relatively quiet until the state amended the law in April 2021to shorten the time available to purchase private LTCi. As of January 2022 WA Cares Fund has a new timeline and improved coverage. Support for Washington states long-term care benefit program is divisive but 51 of Washington residents support the program according to an.

November 1 2021 is the deadline to avoid the new tax by purchasing a private long term care policy. However an employee has a one-time opportunity to opt-out if they have comparable private long-term care insurance see below for details. To opt out an individual must purchase a qualified long-term care insurance plan before Nov.

The only exception is to opt out by purchasing private long-term care insurance. Military spouses can opt out. You must secure private long-term health insurance by Nov.

First to opt out you need private qualifying long term care coverage in force before November 1 2021. In 2019 Washington State enacted legislation to create a public long-term care program. Near-retirees earn partial benefits for each year they work.

Apparently you get a letter to provide to current and future employers to skip the tax. Workers who live out of state can opt out. Does this mean that I can pay one annual premium opt-out and cancel wasting a few hundred bucks for a lifetime of.

OLYMPIA Its almost time for Washington residents to decide between a state long-term health care benefit or a private one. There is a small window to opt out of this premium payroll deduction by proving that I have my own long term care insurance- potentially an exemption period that will be shortened to July 24 2021. In order for the Washington state to allow you an exception to payment of the payroll tax and allow you to opt out of the States Long Term Care plan you will need to show them information about your private policy that is in force prior to your opt out request.

A taxpremium of 0058 of wages to pay into a long term care Washington State program fund is set to commence Jan 1 2022 for all employees who receive W-2 income. Get a Free Quote. Washington state long term care tax opt out reddit.

That tax which goes into effect jan. Workers in Washington state age 18 years or older have a short window in 2021 to permanently opt out of the Trust Program and its payroll tax. Workers on non-immigrant visas can opt out.

Under current law Washington residents have one opportunity to opt-out of this tax by having a long-term care insurance LTC policy in place by November 1st 2021. Beginning in 2022 Washington workers will see a payroll tax for. 1 to avoid the new state tax.

Washington Cares requires Washington. Life Insurance policies with an actual Long-Term Care rider may be the most cost effective way to opt-out depending on age working years assets and income. Starting in January 2022 this program will be funded through a.

Ive read online that if insured by Nov 1 and you opt out by the end of the year that it is a permanent opt-out and you cant opt back in. There are no specific exemptions for hospital or health system employees. 1 2023 exemptions granted to military spouses non-immigrant visa holders and those living outside Washington will not be permanent.

Sponsored by Leverage Planners. Washington State is accepting exemption applications between October 1 2021-December 31 2022. Back in 2019 the state passed a law to fund a public long-term care program through a mandatory payroll tax on every W-2 employee.

Opting back in is not an option provided in current law. Workers already approved for a permanent WA Cares exemption because they hold a long-term care insurance plan do not need to reapply. You must purchase LTCi before November 1st 2021 If you dont yet own long-term care insurance I have good news.

Washingtons new public program. The state has strict guidelines that private long term care policy. The window to opt out of Washingtons new Long-Term Care Insurance.

Seattle Times staff reporter The first day for workers in Washington state to opt out of the WA Cares Fund started with a crash. A 36500 LIFETIME benefit is a joke compared to the current median annual costs of in-home care 64K and nursing home care 109K. The public program offers a lifetime benefit of 36500 to be used in Washington State for a range of services such as memory care in-home personal care and nursing facility care.

This is a permanent opt-out once out you cannot opt back in. First to opt out you need private qualifying long term care coverage in force before November 1 2021.

Long Term Care Insurance Washington State S New Law White Coat Investor

I 1436 Will Give Workers Choices On State S Long Term Care Insurance Program R Seattlewa

The Costs Of Long Term Care By State Accidental Fire

The Long Term Care Offered Out Of Plain Sight How Home Health Caregivers Have Weathered The Pandemic The Spokesman Review

The Costs Of Long Term Care By State Accidental Fire

Who Should Opt Out Of Washington S New Long Term Care Insurance Program King5 Com

Washington State Long Term Care Program Tax Premium Should I Get A Personal Ltc Policy To Opt Out 27yo May Not Get Another Change To Opt Out R Personalfinance

Wa Cares Ltc If You Opt Out And Fail To Present The Opt Out To A Future Employer They Will Tax Long Term Care Insurance Long Term Care Private Insurance

Washington Long Term Care Insurance Rules Change American Association For Long Term Care Insurance

The Costs Of Long Term Care By State Accidental Fire

Deadline Approaching To Opt Out Of Unpopular Long Term Care Payroll Tax R Seattlewa

Thousands Apply For Exemption From Washington S Long Term Care Tax

Long Term Care Benefit Through Chubb Afscme Council 28 Wfse

The Costs Of Long Term Care By State Accidental Fire

Washington State Long Term Care Trust Act Mainsail Financial Group

What Happened To Washington S Long Term Care Tax Seattle Met

Washington S Public Long Term Care Program Is Good Actually And You Should Opt In Slog The Stranger

Another Shock To The Long Term Care Insurance Industry

Why Some Plan To Opt Out Of New Wa Long Term Care Insurance R Seattle